Source: washingtonpost

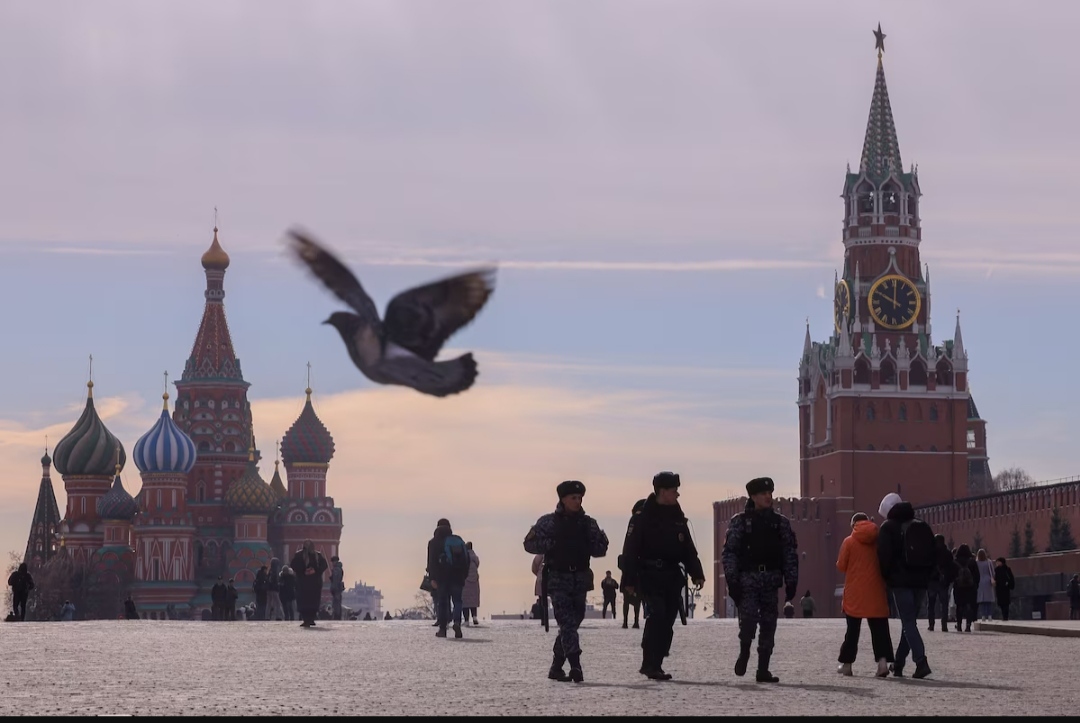

Vladimir Putin’s illegal invasion of Ukraine last year touched off parallel wars. One is the bloody conflict of artillery and infantry. The other is the shadowy, borderless struggle pitting the financial, legal and regulatory might of the Biden administration and its Western allies against Moscow’s sprawling oil- and gas-based economy.

Get the full experience.

Choose your plan

The West’s aim in unleashing the second war — the war of economic sanctions — was to punish Russia and deplete its ability to sustain the ground war in Ukraine. The results of that effort so far are mixed. The sanctions are draining Russian state revenue and shaking the country’s financial underpinnings, gradually isolating Moscow from the global financial system. But they have not sapped its will or capacity to fight — or triggered the Russian economic collapse that some expected.

In the case of sanctions, time should be on the West’s side. With more muscular enforcement and political pressure, including on some U.S. allies, the measures imposed by the United States and European countries can be expected to inflict increasing pain on the Russian president’s regime and the Russian oligarchs who help keep it afloat.

Story continues below advertisement

While Moscow has had some success in mobilizing an international army of sanctions-dodging middlemen, that effort has come with considerable costs. Economists note that even as Russian revenue is dropping — largely as a result of Western measures to squeeze the price it can charge for its energy exports — the Kremlin’s spending has spiked as it struggles to import semiconductors and other material needed to feed a war machine operating on overdrive. The toll is starting to mount: The Russian government’s deficit is soaring and the Russian ruble’s value has sharply fallen in the past six months.

Press Enter to skip to end of carousel

Also on the Editorial Board’s agenda

The misery of Belarus’s political prisoners should not be ignored.

Biden has a new border plan.

The United States should keep the pressure on Nicaragua.

America’s fight against inflation isn’t over.

The Taliban has doubled down on the repression of women.

The world’s ice is melting quickly.

Ihar Losik, one of hundreds of young people unjustly jailed in Belarus for opposing Alexander Lukashenko’s dictatorship, attempted suicide but was saved and sent to a prison medical unit, according to the human rights group Viasna. Losik, 30, a blogger who led a popular Telegram channel, was arrested in 2020 and is serving a 15-year prison term on charges of “organizing riots” and “incitement to hatred.” His wife is also a political prisoner. Read more about their struggle — and those of other political prisoners — in a recent editorial.

The Department of Homeland Security has provided details of a plan to prevent a migrant surge along the southern border. The administration would presumptively deny asylum to migrants who failed to seek it in a third country en route — unless they face “an extreme and imminent threat” of rape, kidnapping, torture or murder. Critics allege that this is akin to an illegal Trump-era policy. In fact, President Biden is acting lawfully in response to what was fast becoming an unmanageable flow at the border. Read our most recent editorial on the U.S. asylum system.

Some 222 Nicaraguan political prisoners left that Central American country for the United States in February. President Daniel Ortega released and sent them into exile in a single motion. Nevertheless, it appears that Mr. Ortega let them go under pressure from economic sanctions the United States imposed on his regime when he launched a wave of repression in 2018. The Biden administration should keep the pressure on. Read recent editorials about the situation in Nicaragua.

Inflation remains stubbornly high at 6.4 percent in January. The Federal Reserve’s job is not done in this fight. More interest rate hikes are needed. Read a recent editorial about inflation and the Fed.

Afghanistan’s rulers had promised that barring women from universities was only temporary. But private universities got a letter on Jan. 28 warning them that women are prohibited from taking university entrance examinations. Afghanistan has 140 private universities across 24 provinces, with around 200,000 students. Out of those, some 60,000 to 70,000 are women, the AP reports. Read a recent editorial on women’s rights in Afghanistan.

A new study finds that half the world’s mountain glaciers and ice caps will melt even if global warming is restrained to 1.5 degrees Celsius — which it won’t be. This would feed sea-level rise and imperil water sources for hundreds of millions. Read a recent editorial on how to cope with rising seas, and another on the policies needed to fight climate change.

End of carousel

That alone will not bring Mr. Putin’s regime to its knees, however. Further steps are necessary, starting with tougher ones to undercut Russian oil revenue.

Image without a caption

Follow Editorial Board’s opinions

Under an innovative measure that took effect in December, Washington and its Group of Seven allies banned businesses from servicing the movement of Russian crude oil — including insurance, shipping and trading firms — unless it is sold below $60 per barrel. Similar caps were imposed on refined Russian petroleum products; the 27 countries of the European Union have also cut off all imports of Russian crude.

Those steps were intended to erode Moscow’s energy income, which before the full-scale invasion of Ukraine accounted for 45 percent of Russian federal revenue. While Russian crude oil has found plenty of willing buyers outside the coalition of sanctioning countries, the Western cap has empowered importers to negotiate lower prices, undercutting the Kremlin’s market leverage. Compared to most of the world’s crude exports, Russian oil is now cheap. Mr. Putin’s own Finance Ministry acknowledged that Russian federal government oil revenue in January had fallen nearly 60 percent since last March, the month after the invasion.

Valve control wheels connected to crude oil pipework in an oil field in the Republic of Bashkortostan, Russia, on Nov. 19, 2020. (Bloomberg)

Simultaneously, however, there are mounting signs that sanction-busting traders and other middlemen are devising schemes to get around the price cap and other Western restrictions on Russian energy exports. This week, for example, the Financial Times published a detailed account of how a firm based in Switzerland, which is part of the sanctions regime, dropped its trading activity in Russian far east oil last June and shifted it to a nearly identically named company in Dubai, which uses lenders in the Middle East and tankers registered in China, India and other countries that have not signed up for the sanctions. The firm in Dubai, Paramount Energy and Commodities DMCC, says it is complying with all relevant “laws and regulations.”

Story continues below advertisement

Western governments should intensify their scrutiny of such stratagems and penalize them where possible. U.S. Treasury Department officials say there is little evidence of widespread sanctions evasion. But independent researchers at Global Witness, an advocacy group, say enforcement of the price cap is lax.

Beyond more aggressive enforcement, there are other ways to tighten the vise on the energy exports Mr. Putin uses to finance his war.

The aim of setting the cap on Russian crude at $60, roughly 20 percent below the main international benchmark price, was to whittle away at Russia’s cash hoard while still providing it with sufficient incentive to maintain exports and keep global oil markets stable. It is now time to lower the Western cap further, in increments, to $40 per barrel or less, in line with recommendations from the Kyiv School of Economics and former U.S. ambassador to Russia Michael McFaul. Even at that level, Moscow would turn a profit on its oil, whose production costs are among the world’s lowest, and would be unlikely to slash output; it has few other reliable revenue-generating options.

Story continues below advertisement

The West would be wise to turn up the heat on banks, including ones in the West, that handle Russian energy earnings. That includes Gazprombank and its subsidiary in Luxembourg, the principal channel for ongoing European payments for Russian natural gas, whose flow to the continent has been slashed but not eliminated.

Press Enter to skip to end of carousel

Opinion writers on the war in Ukraine

Post Opinions provides commentary on the war in Ukraine from columnists with expertise in foreign policy, voices on the ground in Ukraine and more.

Columnist David Ignatius covers foreign affairs. His columns have broken news on new developments around the war. He also answers questions from readers. Sign up to follow him.

Iuliia Mendel, a former press secretary for Ukrainian President Volodymyr Zelensky, writes guest opinions from inside Ukraine. She has written about trauma, Ukraine’s “women warriors” and what it’s like for her fiance to go off to war.

Columnist Fareed Zakaria covers foreign affairs. His columns have reviewed the West’s strategy in Ukraine. Sign up to follow him.

Columnist Josh Rogin covers foreign policy and national security. His columns have explored the geopolitical ramifications of Russian President Vladimir Putin’s war in Ukraine. Sign up to follow him.

Columnist Max Boot covers national security. His columns have encouraged the West to continue its support for Ukraine’s resistance. Sign up to follow him.

End of carousel

The United States and its allies can also expand individual sanctions against Russian oligarchs who prop up the Kremlin. In December, Canada became the first G-7 country to pursue the forfeiture of frozen assets from a sanctioned oligarch, Roman Abramovich, who has served Mr. Putin for years. Under a law enacted last year, Ottawa said it would use the $26 million from Granite Capital Holdings Ltd., owned by Mr. Abramovich, for the reconstruction of Ukraine and to compensate Ukrainian war survivors.

The broader question of whether to seize some $300 billion in frozen Russian central bank assets in Western and Japanese banks to eventually rebuild Ukraine is trickier. In one way or another, Russia should be made to pay the lion’s share of the hundreds of billions of dollars that will be required for Ukraine’s reconstruction. But seizing central bank funds could damage the international financial system, in which such assets are assumed to be sacrosanct. The E.U. established a working group to study the question, a move initiated by the current Swedish presidency of the Council of the European Union. A smart first step for the working group would be to cast a more transparent light on the assets themselves — where they are held, and in what form and quantities.

Story continues below advertisement

Mr. Putin is convinced that time is his ally in Ukraine, and that the West will tire of the cost and commitment required to defend Kyiv and help it win back territory lost to the Russian dictator’s land grab. Bleeding Russia’s economy with tougher sanctions and enforcement is one way of persuading him, along with other Russian elites, that the price of his folly will be higher, last longer and cause more pain than the Kremlin currently imagines.